Demat accounts are mandatory for investing in securities after the digitalisation of the stock market operations. While it is quite easy and hassle-free to open a Demat account, people often wonder and ask, “ can I open a Demat account without a pan card?” You will find the details about how to open a free Demat account, the documents that you will need to provide, and other details in this article.

What is a Demat Account?

A Demat account is like a bank account where all your investments, whether in shares, mutual funds, commodities, currencies, or others, are held. Demat account has its importance. Without a Demat account, you cannot sell the securities you buy or especially, invest in, and also for delivery trades.

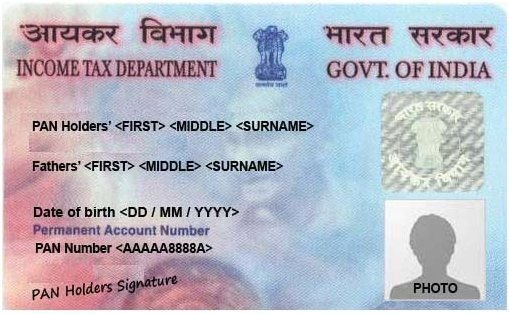

Can I Open a Demat Account Without a PAN Card?

As per SEBI guidelines in the circular issued in 2007 on 27th April, without a PAN card, a Demat account cannot be opened. Even the accounts that were opened before this date become inoperable when it comes to debit transactions if there is no PAN card verified with the account. Thus, PAN is necessary to open a Demat account and also linked to existing accounts.

How to Open a Demat Account?

If you want to open a free Demat account, then you need to follow the steps mentioned below –

- The first thing you need to do is choose the brokerage house where you want to open the Demat account.

- Then visit their website, and look for the account opening option.

- Fill out the form with details as required. Usually, you will have to enter your name, address, income details, and other details, as required.

- Once you apply, the brokerage house will verify these details and ask you to provide supporting documents. The list of documents usually required by brokerage houses are –

- PAN card

- AADHAAR

- Bank statement

- Income proof

- Once the documents and the details are verified, your Demat account will be created, and the details will be shared with you over your registered email address.

Is There Any Exception to This Rule of a PAN Card Being Mandatory for Demat?

While PAN is mandatory for trading in securities and thus for opening a Demat and trading account, there are certain circumstances where you can open a Demat account without a PAN card, as well. Here are those exceptions –

- Firstly, if you open a Demat account as a HUF, association of persons, unregistered trust and partnership firm. The PAN card of the organisation or the respective body shall be obtained. Though these organisations have multiple members and heads, the PAN card will be in the name of the organisation itself.

- Then if the entity who is opening the Demat account is a SEBI registered one under section 12 of the SEBI act 1992, they do not need to have PAN for opening a beneficiary account. However, this account will be valid only for 30 days, after which you need to submit PAN details for the use of the account.

- Another set of entities exempted from submitting the PAN card entirely is UN agencies and similar agencies, which are exempted from paying taxes, as well. However, after applying for the Demat account, the verification is done thoroughly and strictly to assess the status of the agencies, and only then the Demat account application gets approved.

- PAN is also not mandatory for people from the scheduled tribes of North East, including Mizoram, Tripura, Manipur, Arunachal Pradesh, Nagaland, and some other parts of Assam. However, these Demat accounts can only be used for investing in assets worth Rs. 50000 and not more than that.

Conclusion

If you want to trade and invest in securities, then you need to have a Demat account for which you need a PAN card as a mandatory document. However, as stated above, there are certain exceptions to this rule, and only if you belong to any such categories of individuals or entities, you can open a Demat account without a PAN card.