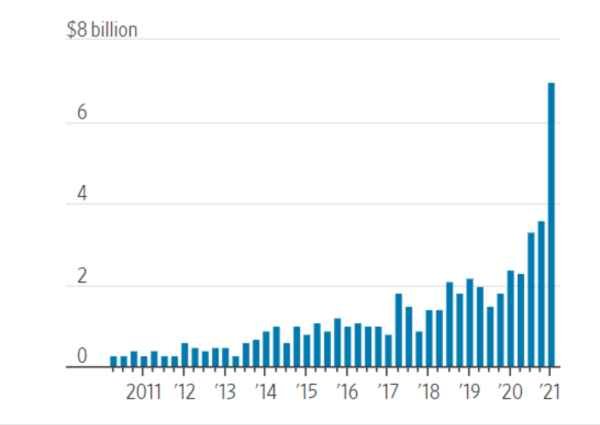

Rolfe Winkler in The Wall Street Journal reports that digital health startups have raised over $7B in Q1 of 2021, and the public is overwhelmed by the price cuts and cost management. [7B Q1Winkler StreetJournal]

The COVID-19 pandemic has increased the demand for digital health services worldwide. As a result of quarantine measures, many of us were required to stay at home, which presented a challenge when it came to accessing minor medical checkups. In response, there was a significant uptick in the development of digital startups to address this issue.

What’s best about digital health startups is the lower cost and accessibility. For instance, the services where you don’t involve the physicians actively are somewhat cheaper.

On the downside, the growth of digital health companies has led to the creation of many new businesses. However, some experts believe that the market is saturated with companies that offer similar products or services at high prices.

As a result, health benefit executives are urging these digital health companies to differentiate themselves by offering more services, collaborating with complementary companies, and reducing their prices. This pressure is forcing digital health companies to work harder to distinguish themselves from their competitors. [7B Q1Winkler StreetJournal]

According to recent research published by a venture capital firm called 7Wire Ventures, the Covid-19 pandemic has led to the creation of more than 100 digital healthcare startups. Along with digital health services, they offer health apps that monitor your physical activities such as diabetes, sleep schedule, training, heart rate, etc.

Other than that, they have pre-made as well as customized plans for your fitness goals.

“We are inundated…We already have these very big portfolios of vendors. And with all this new stuff coming into the market, there’s no way to assess, literally thousands,” stated the Director of benefits at CarMax, Inc., Meredith Touchstone.

An explosion of digital-health startups has executives in corporate benefits excited about lowering costs, but has also spawned a glut of redundant services https://t.co/GquGgcxBDh

— The Wall Street Journal (@WSJ) May 3, 2021

PitchBook recently reported that the digital healthcare sector has been successful in receiving $7 billion in the Q1 of 2021. This amount, according to PitchBook research, is the highest of the last decade.

Venture-capital investment has reached an all-time high in the first three months of the year 2021. As matter of fact, the investment in the said year has reached more than double the last year’s median value. This is because of the continued growth of technology companies and increased interest from investors in these types of businesses. [7B Q1Winkler StreetJournal]

In addition, there is a trend among startups to delay raising money through public markets. What it means is that they are relying more heavily on venture capital investment to fund their operations. This has led to a multiyear period of strong investment activity in the VC industry.

In the United States, some large employers work with insurance companies to provide healthcare coverage for their employees. However, the employers ultimately bear the cost of providing healthcare.

Digital health apps aim to help these employers control healthcare costs by focusing on specific areas of healthcare and using digital tools to monitor results. The idea is that by using digital technology to track and manage healthcare, employers can reduce costs and improve the overall health outcomes of their employees.

The pandemic caused an increase in demand for remote healthcare services through digital technology. Regulators allowed doctors to practice across state lines, and Medicare expanded telehealth coverage. This led to increased investment and funding in the digital-health sector, including the $13.9 billion merger between Teladoc Health and Livongo.

“Everybody’s excited because there’s so much damn money floating around. After Livongo got sold, everyone said, ‘Where’s my piece?’ I get that Wall Street loves these things, but do they work? It’s not clear yet,” said the CEO of Cambridge Advisory Group, Stuart Piltch.

It is challenging to know if digital-health services are useful because it is hard to prove that they can reduce costs or improve healthcare. According to Erik Sossa, a former executive at PepsiCo, digital health services work best when they are connected to a company’s current health plan.

“Telemedicine is a fantastic medium, but if it’s just late-night urgent care, it’s kind of a commodity,” says Mr. Sossa.

That way, doctors can access a patient’s health history and offer better care. This is why Pepsi now uses LiveHealth Online instead of Teladoc for telemedicine services. A spokesperson for Teladoc said they have been working with Pepsi for some time, but Pepsi has not commented on the matter.

Employers want digital-health providers to team up with insurers and cover more health conditions. They want services to only charge employees when they use them, not a monthly fee. Digital-health companies, including Omada Health and Livongo, are expanding their services to compete with each other.

Care navigation is also growing, with Grand Rounds and Accolade acquiring other companies to expand their services. There is more competition in the market, leading to more deals, with Teladoc buying multiple companies. In the meanwhile, former Livongo chairman Glen Tullman launched his own care navigation company so you need to expect more consolidation in the digital health sector. [7B Q1Winkler StreetJournal]

Suggested Reads:

Sources Coinbase 100b 141m, Sources Say Coinbase is Valued at over $100B generating $141M net Income in 2020